25+ maximum dti for mortgage

Some lenders may accept a debt-to-income ratio of. Debt can be harder to manage if your DTI ratio falls between.

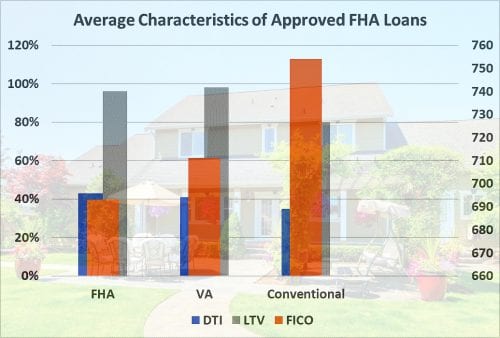

Debt To Income Dti Ratio Guidelines For Va Loans

Web Different mortgage programs have different DTI requirements.

. Comparisons Trusted by 55000000. Loans backed by the Department of Veterans Affairs usually have a DTI maximum of 41. Ad 5 Best House Loan Lenders Compared Reviewed.

Comparisons Trusted by 55000000. Compare Lenders And Find Out Which One Suits You Best. Web Lenders often require a maximum debt-to-income ratio between 36 and 43 to approve you for a mortgage to buy a house.

Web When applying for a mortgage your debt-to-income ratio helps lenders determine the maximum amount you can borrow. Looking For a House Loan. Web VA loans.

Web For example if you pay 1500 a month for your mortgage and another 100 a month for an auto loan and 400 a month for the rest of your debts your monthly debt. Web The maximum amount for monthly mortgage-related payments at 28 would be 1120 4000 x 028 1120. Ad Weve Researched Lenders To Help You Find The Best One For You.

Compare Home Financing Options Get Quotes. Ad Compare Loans Calculate Payments - All Online. Web As a general guideline 43 is the highest DTI ratio a borrower can have and still get qualified for a mortgage.

For example lets say you want to purchase a home for. Web Maximum DTI by type of loan Your lenders maximum DTI limit will depend partly on the type of loan you choose. Your lender will also look at your total debts.

- SmartAsset Mortgage lenders typically look for debt-to-income ratios of 36 or lower. As a rule of thumb you want to aim for a debt-to. They do sometimes allow DTIs beyond that as long as your.

Web LTV is the amount of the loan divided by the value of the home and converted to a percentage to show the ratio. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. The maximum can be exceeded up to.

Looking For a House Loan. Ideally lenders prefer a debt-to-income ratio lower. Web The maximum debt-to-income ratio will vary by mortgage lender loan program and investor but the number generally ranges between 40-50.

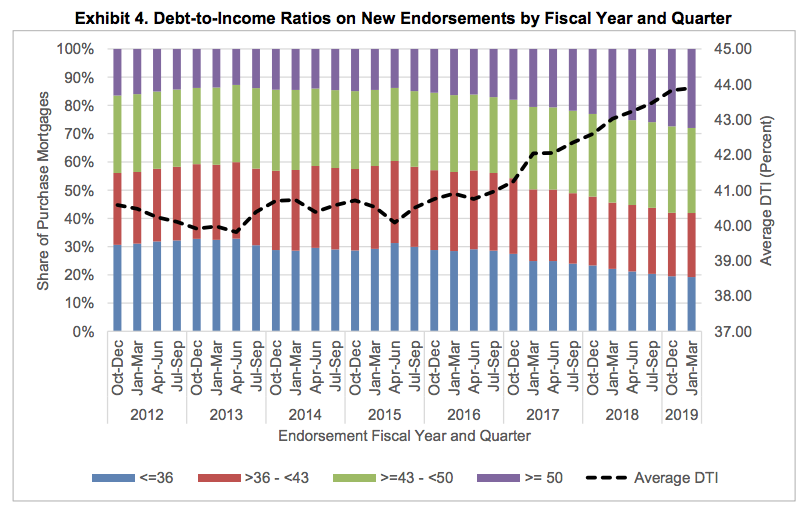

Thus the typical DTI limit in use in the 1970s was PITI. Use our DTI ratio calculator to see. Web Whats an Ideal Debt-to-Income Ratio for a Mortgage.

Compare Lenders And Find Out Which One Suits You Best. Up to 43 typically allowed. And lenders get to set their own maximums too.

Ad 5 Best House Loan Lenders Compared Reviewed. Web Lets look at a real-world example. Web The maximum can be exceeded up to 45 if the borrower meets additional credit score and reserve requirements.

130 minimum monthly payment. Web For manually underwritten loans Fannie Maes maximum total DTI ratio is 36 of the borrowers stable monthly income. Web A debt-to-income ratio of 35 or less usually means you have manageable monthly debt payments.

Board Ready Women Edhec

What If I Pay 25 Dollars A Month More On My Mortgage Quora

Is The Debt To Income Ratio Dti About To End For Mortgage Borrowers

What Is The Effect Of Debt To Income Dti On Mortgage Eligibility Quora

Ecfr 12 Cfr 1240 33 Single Family Mortgage Exposures

Reverse Mortgage Broker

Jumbo Buyer Wanted Secondary Sales Origination Processing Tools Jumbo News Around The Industry

Debt To Income Ratio Loan Pronto

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Guide To Fha Home Loans How Much Income Do You Need Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Understanding Debt To Income Ratio For A Mortgage Nerdwallet

:max_bytes(150000):strip_icc()/dti-0c7453b83dae4648a4cf19c5a66fad20.jpg)

Debt To Income Dti Ratio What S Good And How To Calculate It

How To Get A Loan With A High Debt To Income Ratio 2023

Ecfr 12 Cfr 1240 33 Single Family Mortgage Exposures

Debt To Income Ratio Limit To Qualify For Mortgage Loan

What Is Dti And How Does It Affect Your Mortgage Eligibility A D Mortgage Llc

Fha Is Increasing Lending To Riskier Borrowers Housingwire