Cost of preferred stock calculator

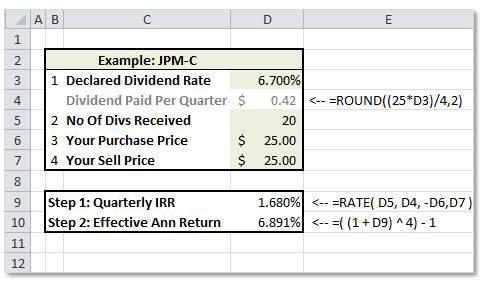

Simply enter the dividend annual the stock price most recent and the growth rate or the dividend payments this is an optional field. The dividend yield ratio also referred to as the dividend price ratio is a common way of calculating the relative value of a dividend payout for a dividend paying stock based off of the stocks market value.

Common Stock Formula Calculator Examples With Excel Template

Stockholder or acquired additional shares through open-market purchases by participating in The DirectSERVICE Investment Program or one of its predecessor plans or through employee plans.

. College Essay Help Services. Using the free online Dividend Yield Calculator is a quick way to calculate the dividend yield of any dividend paying stock. Cost of Preferred Stock 400 5000 80.

Best Service 0 Regrets. Money which is spent on non-essential products or services is gone for good. The June Consumer Price Index CPI inflation report shows that the 12-month change in.

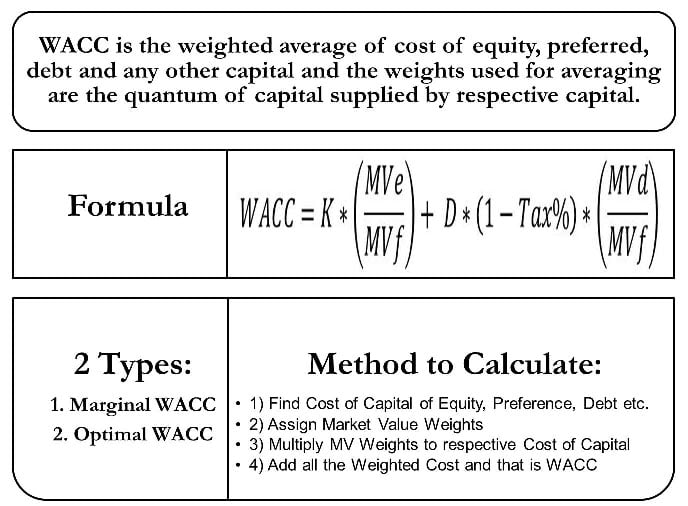

The number of shares the preference shareholder is holdingPreference shareholders are entitled to get fixed dividends on a regular interval. A companys WACC is the rate of return required for a business to maintain operations. For example if a company owns 20 or more of another distributing companys stock they dont have to pay taxes on the first 65 of income received from dividends.

Our stock profit calculator will assist you in managing your risk-to-reward ratio by calculating your return on investment. One of these indicators is ROI - return on investmentIt tells you what percentage of the initial investment will return to you in the form of profit. Topic subject area number of pages spacing urgency academic level number of sources style and preferred language style.

The stock eventually rose to 2432 per share allowing the Oracle of Omaha to exercise those warrants for more than 17 billion reflecting a 12 billion gain on the original investment. The reason is that preferred stockholders have a higher claim to dividends than common stockholders do. Enter the symbol and cost basis you want to analyze and click Go.

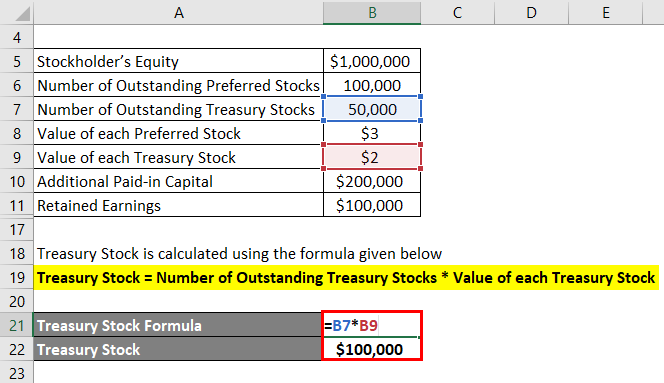

Preferred stock dividends are deducted on the income statement. Cost of Preferred Stock Calculator. The formula for fixed cost can be calculated by using the following steps.

It not only cant be spent again but it also cant earn incremental cashflow. Opportunity Cost Formula Table of Contents Opportunity Cost Formula. The formula used to calculate the cost of preferred stock with growth is as follows.

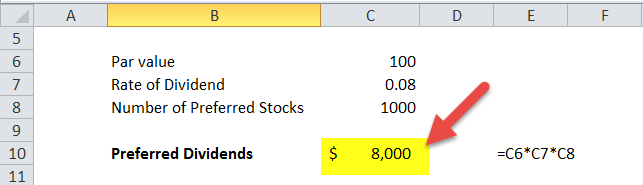

Many companies include preferred stock dividends on their income statements. Cost of equity is the rate of return an investor required for investing equity into business. This Excel file can be used for calculating the cost of preferred stock.

Your Preferred Online Essay Writing Service. Get Dividend Data For. You may have become an ATT Inc.

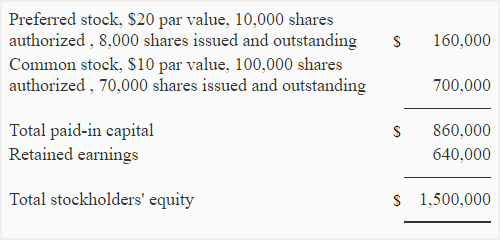

Cost of preferred stock is the rate of return required by the investor. Common equity preferred stock debt. The face value of a bond or any fixed-income instrumentPar value is also known as Face Value or Nominal Value.

As the name suggests these costs are variable in nature and changes with the increase or. As for the next type of preferred stock the assumption here is that DPS will grow at a perpetual rate of 20. However there are some indicators that you can calculate to check the profitability of such an investment.

1 Ranked Expert Writers. Then they report another net income figure known as net income applicable to common. If you want to customize the colors size and more to better fit your site then pricing starts at just 2999 for a one time purchase.

Cost of Equity Discount Rate. The preferred stock valuation calculator exactly as you see it above is 100 free for you to use. Similar to unlevered free cash flows FCFs the WACC represents the cost of capital to all capital providers eg.

Bonds long-term debt common stock and preferred stock. Opportunity Cost Formula Calculator. For example if a stock currently trades at 40 and an.

The commute cost calculator exactly as you see it above is 100 free for you to use. The information needed include. Opportunity cost can be termed as the next best alternative of a particular option which has been executed or about to execute.

Click the Customize button above to learn more. You also give your assignment instructions. According to available market information the 1-year unlevered beta of the company stock is 189.

During 2018 the companys reported long-term borrowings current portion of long-term liabilities and short-term borrowings stood at 008 billion 003 billion and 1235 billion respectively as on balance sheet. People in debt have money working against them 24 hours a day while those with savings are able to have the money work for them. Cost of Preferred Stocks.

To determine your cost basis you need to know the original price paid for the shares the date you acquired them and how you acquired them. Preferred stock is a special type of stock that pays a set schedule of dividends and does not come with voting rights. If you want to customize the colors size and more to better fit your site then pricing starts at just 2999 for a one time purchase.

Inflation may finally be cooling offbut it remains troublingly high hurting Americans finances. Options are purchased by investors when they expect the price of a stock to go up or down depending on the option type. Fixed Cost Explanation.

Where Number of preferred stocks. Now that you know your stock profit you already have an idea of how much sense it makes to invest in stocks. You can determine the optimal initial investment by entering the total value of the stock you desire to purchase along with your preferred purchase price and selling price in order to calculate stock profit or loss.

To calculate Yield to Call please click here for the Preferred Stock Calculator. Best Long Distance Moving Companies Moving Cost. There are multiple types of cost of equity and model to.

The rate at which the dividend will be paid out it is. Companies also use preferred stocks to transfer corporate ownership to another company. Download the Free Template.

Stock Options. Firstly determine the variable cost of production per unit which can be the aggregate of various cost of production such as labor cost raw material cost commissions etc. For one thing companies get a tax write-off on the dividend income of preferred stocks.

How to Use Essay Writing Services Correctly. If youre building an unlevered discounted cash flow DCF model the weighted average cost of capital WACC is the appropriate cost of capital to use when discounting the unlevered free cash flows. Cheap Guaranteed Quality 100 Satisfaction.

The WACC includes all sources of capital including. Click the Customize button above to learn more. 1 Law Assignment Help Service.

The WACC formula looks at the pro-rata cost of debt and equity in order to get a complete picture of a companys capital structure. Trading Par 25 Call Date 1yr Moodys SP rated if it meets any one of the criteria. Opportunity Cost Formula in Excel With Excel Template Opportunity Cost Formula.

Cost of Preferred Stocks k p Dividend D o Current Market PriceP 0 Cost of Equity. Therefore we enter our numbers into the simple cost of preferred stock formula to get the following. Focus on Affordability and 1010 Quality.

Retail Investor Org Nitty Gritty Ofpreferred Shares How They Work Investor Education

Cost Of Preferred Stock Equity Financing In Startups Plan Projections

Common Stock Formula Calculator Examples With Excel Template

Cost Of Preferred Stock Rp Formula And Calculator Excel Template

Preferred Stock Investors What Is Your Rate Of Return Seeking Alpha

Preferred Stock Returns Convertible Vs Participating Equity

Cost Of Preferred Stock Calculator Calculator Academy

Preferred Dividend Definition Formula How To Calculate

Preferred Stock Pv Formula With Calculator

Cumulative And Noncumulative Preferred Stock Explanation And Example Accounting For Management

Wacc Formula Definition And Uses Guide To Cost Of Capital

Common Stock Formula Calculator Examples With Excel Template

Wacc Calculator Calculates With Detailed Formula With Explanation Efm

How To Calculate The Value Of A Preferred Stock In Microsoft Excel Microsoft Office Wonderhowto

Cost Of Preferred Stock Rp Formula And Calculator Excel Template

Cost Of Preferred Stock Calculator Calculator Academy

Preferred Dividend Definition Formula How To Calculate